Millions of people enter the financial markets with dreams of making a fortune. But the exchange is set up like this: if someone loses, then the other earns at that moment. In the stock markets there will always be unscrupulous bidders who want to capitalize on inexperienced investors. You can influence quotes artificially: through the spread of false news or technical manipulations with orders. One such market manipulation scheme is the pump&dump strategy. We tell you what its principle of work is and how not to become a victim.

Principle of operation

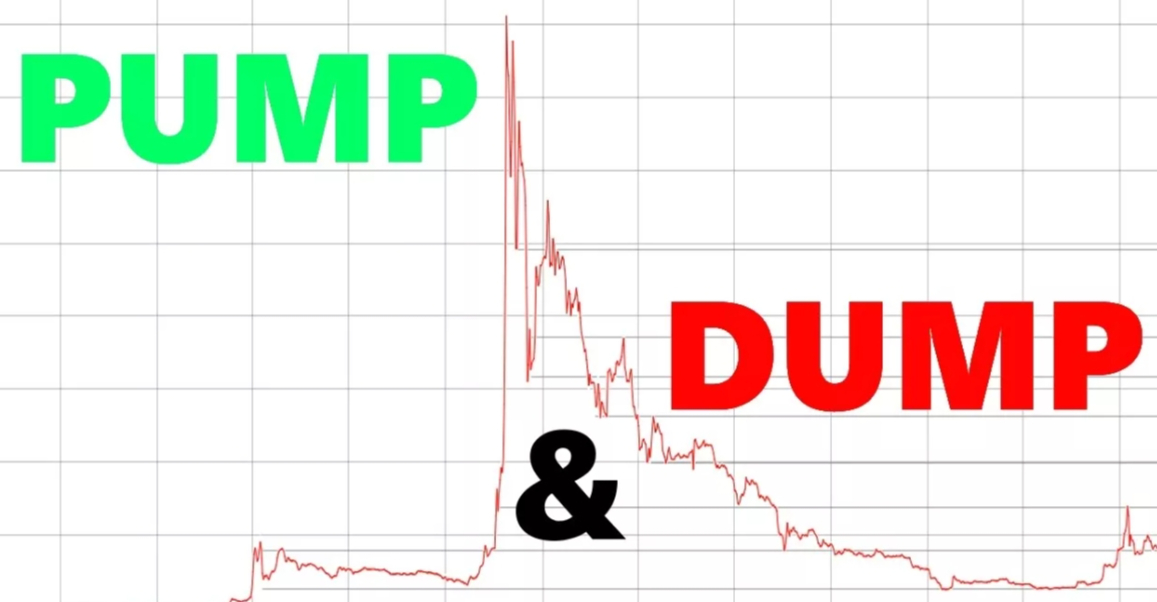

The essence of the process is to “pump up”, or disperse, the quotes of the selected financial asset and then sharply drop the price through the sale. This type of market manipulation got its name in the 1990s, although it existed long before that. The acceleration of quotes occurs through the spread of false news, which are presented as insider information. They increase the quotes of the selected stock or other asset, as they give positive forecasts.

Initiators are interested individuals or a group of investors-traders who want to make money on manipulations. Such a group of unscrupulous traders, or pampers, conducts targeted actions and campaigns in the media, popular social networks, forums and creates demand, even excitement, around the issuer. Novice traders want to make money quickly and easily, so they invest money. The share price rises until it reaches the level set by the manipulators. At this moment, they sell their assets, and quotes fall. Those who did not have time to sell securities before the fall lose their investments.

The protection of free and honest relations in the financial markets and the identification of illegal actions is carried out by a special division of the SEC – the Securities and Exchange Commission.

Influencing the stock price by spreading false news is one of the oldest and most proven methods. He is colorfully described in the popular film with Leonardo DiCaprio – The Wolf of Wall Street. The main character, Jordan Belfort, was selling frankly “junk” shares. With empty and impudent promises of high profits, he attracted investors and sold hundreds of millions of dollars worth of shares.

How not to fall into a trap?

In order not to become a victim of price manipulation, it is enough to follow simple rules. Do not respond to calls of this kind – “We must urgently buy, because we just received insider information.” One of the main signs of fraud is the requirement to perform an action here and now, the user is not given time to analyze the situation. Such sudden transactions help to “rock” the price.

An experienced trader never opens a deal on emotions, he will think ten times. It is better to miss the opportunity to make money on the current trade than to lose money.